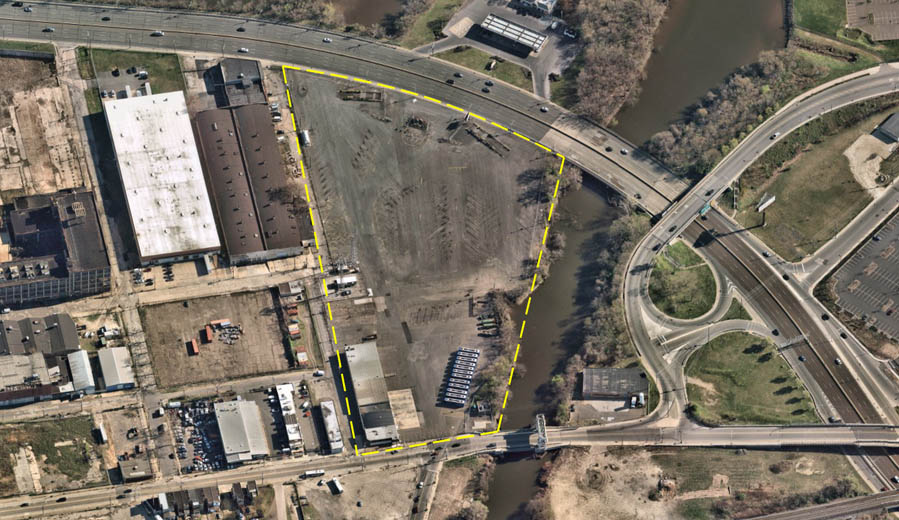

Rosemont, IL – October 6, 2020 – Venture One Real Estate through its acquisition fund, VK Industrial V, LP, a partnership between Venture One and Kovitz Investment Group, has closed on the acquisition of a 9.40 acre, fully paved, fenced, and lit logistics property located at 1521 Admiral Wilson Boulevard in Camden, New Jersey. The property was vacant at acquisition and will be marketed for lease or sale.

The property sits on 9.40 acres and feature a 17,290 SF repair/maintenance facility equipped with 12 drive-in repairs bays, floor drains and 2,800 SF of existing office. It can accommodate over 236 trailers, 517 sprinter vans and other motor freight vehicles. The site is located less than 1.7 miles from downtown Philadelphia via the Benjamin Franklin Bridge and has access to I-295 and the New Jersey Turnpike via I-676.

Jim Scott of Colliers international represented the Seller in the Transaction. Scott Mertz of NAI Mertz represented Venture One and will be retained the market the property.