Rosemont, IL – January 6, 2022 – Venture One Real Estate through its acquisition fund, VK Industrial V, LP, a partnership between Venture One and Kovitz Investment Group, has closed on the acquisition of a 7.37-acre industrial outdoor storage (IOS) site located at 1798 Hagemann Drive in Batavia, Illinois. The property was vacant at the time of acquisition.

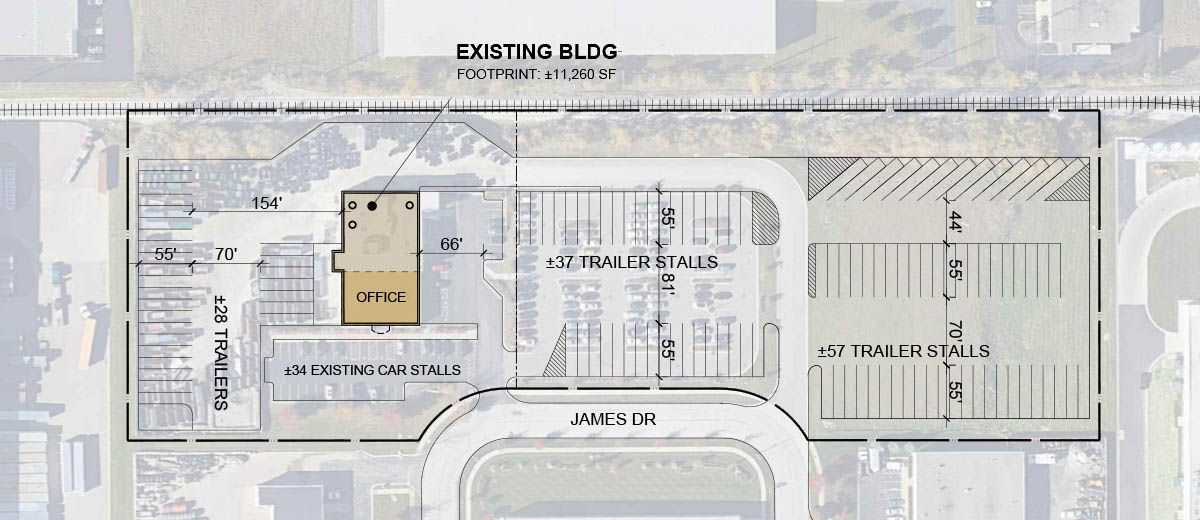

The 7.37-acre site is equipped with an 11,835 square foot truck repair/maintenance facility and can accommodate over 120 trailer positions. Venture One’s planned make ready improvements include installing 2 drive-in repair bays with triple-catch basin floor drains, renovating the existing 4,743 square feet of office, paving the entire site, installing energy efficient lights throughout the parking lot and fencing the premises.

David Prell and Ted Gates of CBRE represented the Seller in the transaction and will be retained to market the property for Venture One.